Using debt effectively

Smart Strategies for 2020

William Shakespeare wrote, ‘Neither a borrower nor a lender be’, but the fact is debt can be a very useful tool – when used properly.

Appreciating the value of debt

Using debt, you could buy a house you may not be able to afford outright. You just need enough to cover the deposit and costs and you can borrow the rest, assuming you can make the repayments.

Debt can also be used to buy investments with potential to grow in value, like shares and property. This strategy, known as gearing, may help you to build an investment portfolio faster than you otherwise could have.

To help repay the loan, you’ll have income generated by your investments. So, for many people, servicing an investment loan may be an achievable outcome.

In this booklet, we outline nine strategies that have the potential to be highly effective in helping people make the most of debt.

Individually, each strategy could significantly improve your financial position. By using a number of them in combination, you could optimise your finances and achieve financial independence sooner.

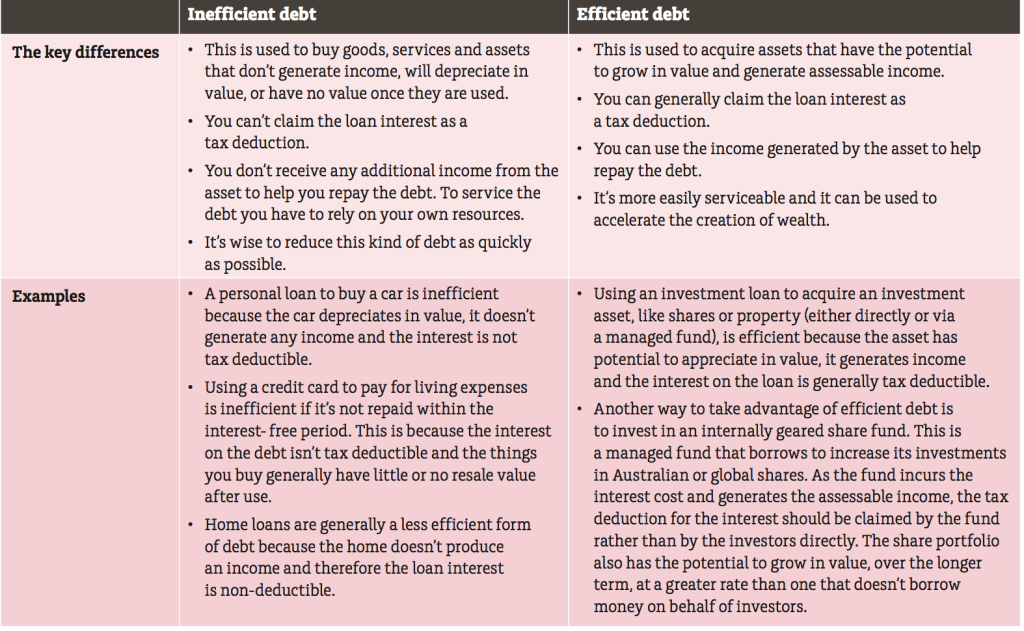

There are two types of debt you could use:

Strategies at a glance

|

Strategy |

Potential key benefits |

|

|

1 |

Consolidate your debts to save money |

|

|

2 |

Use your emergency cash reserve more effectively |

|

|

3 |

Harness your cashflow to reduce inefficient debt |

|

|

4 |

Use borrowed money to build wealth |

|

|

5 |

Transform your debt using a financial windfall |

|

|

6 |

Build wealth via debt recycling |

|

|

7 |

Offset your investment loan to retain cash-flow efficiency |

|

|

8 |

Make gearing more effective for a couple |

|

|

9 |

Leverage your investment via an internally geared share fund |

|