What do You Consider to be Your Most Important Asset?

It might not be what you think it is!

Disclaimer

Any advice contained on this page is of a general nature only and doesn’t take into account your personal circumstances or needs. You must decide if this info is suitable to your personal situation or seek advice. Prior to investing in any particular product, you should read the product disclosure statement.

BMK Financial Services is a corporate authorised and credit representative of Charter Financial Planning. (Australian Financial Services and credit licensee AFSL & ACL No. 234665 ABN 20168684008).

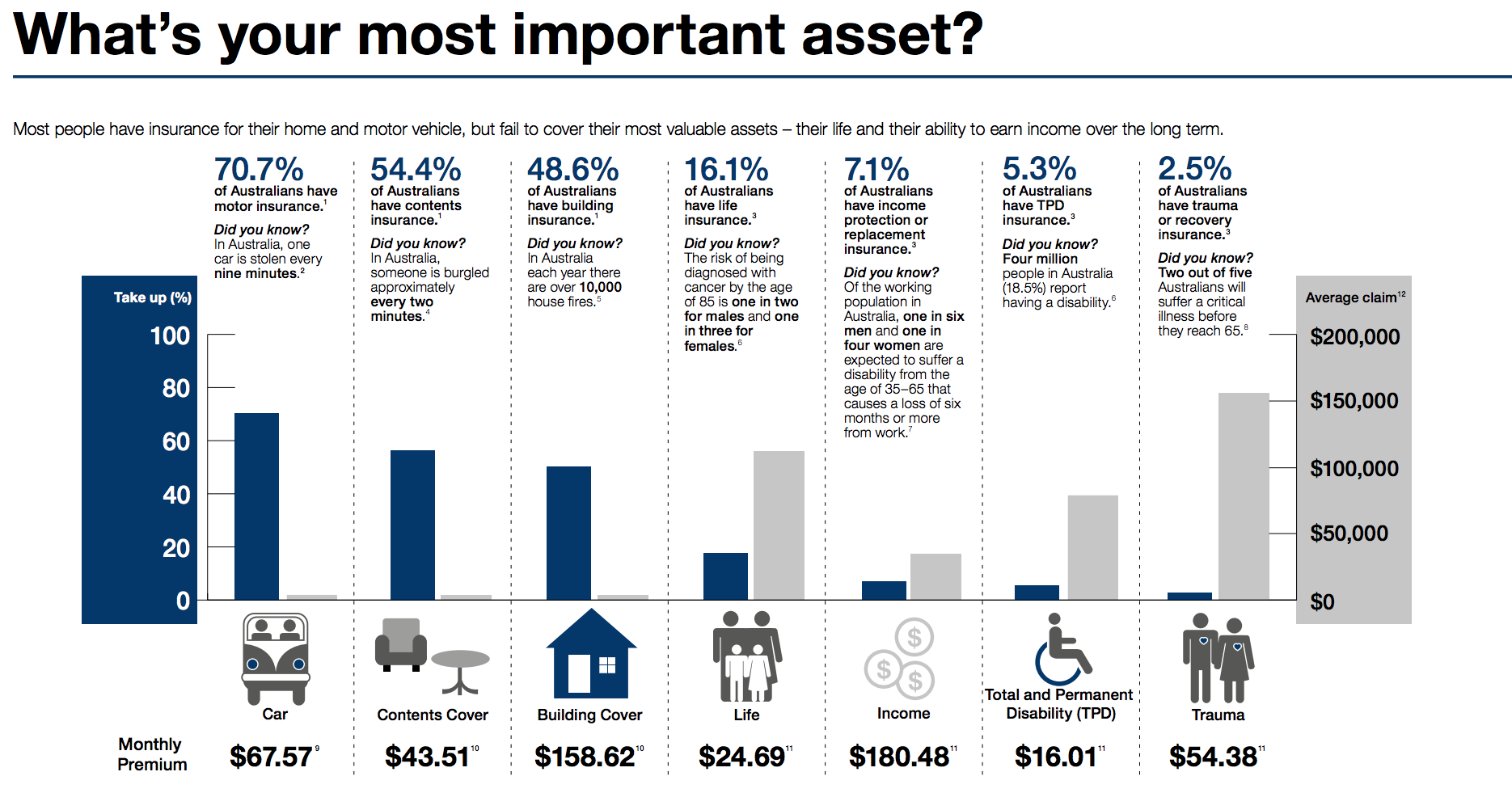

When most people consider their most important asset, they often quickly jump to the most expensive thing they have purchased. And it shows in the most popular insurance premiums. The graph below conveys the most popular types of insurance that Australians take out (according to 2015/16 data)1.

It is quite clear that the asset that is most forgotten when getting insurance is the asset that enables the purchasing of the car or house, yourself!

That’s right, you are the most important financial asset you will ever have.

According the Australian Bureau of Statistics (at Nov 2019) the average annual income is $86,2682. Over the course of a 40 year working career, over $3.4 million worth of wages and salary will pass through your hands. With super included, the average Australian will generate over $3.7 million.

At least some of that $3.7 million will go into purchasing the assets that we like to cover the most: our homes, cars and contents. This $3.7 million will also be used to support the people and causes we love the most – your partner, your kids, and even your favourite charity.

Should you consider insuring yourself?

It can be easy to forget about insuring ourselves. After all, it did not cost us a lump sum to buy ourselves. Insuring yourself is an important step in protecting and growing your wealth. Here are three reasons why you should consider insuring yourself:

- All your current assets directly or indirectly rely on your ability to produce income.

- The majority of Australians have less than 1 month savings if they lost their job. How will you take care of all your expenses if you physically can’t work or can’t find employment?

- Are you the major source of income for your family?

With the recent pandemic, it is clear that having the right protection in place is crucial. If you can’t afford income protection right now, talk to Brad today about how you can use your super to protect your income.

Talk to Brad Lonergan today if you want to get the right income protection insurance for you.

1. Count Financial Limited, What’s Your Most Important Asset.

2. Australian Bureau of Statistics – Average Weekly Earnings, Australia, Nov 2019.

Is it Time to Look Into Getting You and Your Family the Right Protection in Case Something Happens? Or Just Interested in Getting More Information to Determine if a New Insurance Policy is Right for You?

Contact BMK Financial Services on 0423 621 120 or brad@bmkfs.com.au

Brad Lonergan has 0ver 20 years experience in the Financial Services industry. He helps individuals and families plan for their best financial future. BMK Financial Services primarily services those in the Lake Macquarie and Newcastle area, but his expertise has seen him work with people all across Australia.